- Benzinga Advisor

- Posts

- Half Of Americans Have 72+ Month Car Payments | Microsoft, Tesla, Meta, Apple Earnings

Half Of Americans Have 72+ Month Car Payments | Microsoft, Tesla, Meta, Apple Earnings

Plus, the latest in market news.

Happy Sunday, and welcome to Benzinga’s financial advisor newsletter.

Today we're talking about auto loans, which are becoming a growing source of cash flow strain in households. Lower rates have helped buyers get approved, but longer loan terms are quietly extending financial stress with half of Americans now having car payments that exceed 72 months. Read on to see why this is becoming a key signal for advisors.

Plus, a look at all the top stories and market activity from this past week.

Advisor Spotlight: If you would like to be featured in our upcoming Advisor Spotlight and showcase your business, click here to send us an email.

Benzinga Newsletters: If you are enjoying this newsletter, be sure to check out our other free newsletters with exclusive interviews and market insights.

Table of Contents

INDUSTRY CHATTER

Last summer, auto loan rejections were cut in half, falling from 42% in February to just 15% by June. Credit became easier to access, yet for many Americans, affording a car didn’t get easier — it just got longer.

Auto loan terms continue to stretch as buyers trade time for monthly payment relief. That shift helps explain why auto debt is quietly becoming one of the more stressful lines in the household budget. Inflation has cooled and lending has loosened, but car prices remain high, and the financing decisions made over the past few years are still shaping household cash flow.

On the surface, balances don’t look dramatically different by generation. Millennials and Gen Xers hold the largest average auto loan balances, both around $22,500, with baby boomers not far behind. Even Gen Z borrowers average just over $20,000. The real story isn’t how much people borrow — it’s how they’re structuring that debt.

Longer auto loans are now the norm rather than the exception. More than half of Gen X borrowers have loan terms longer than 72 months, and a meaningful share of millennials are stretching past 80 months. The logic is understandable: longer terms soften the monthly hit. But they also lock households into payments long after the initial affordability problem should have passed. Interest rates compound the issue, with Gen Z borrowers facing the highest rates, averaging around 13%, reflecting thinner credit histories and lower incomes.

Despite those longer terms, monthly payments are still uncomfortably high. Nearly 1 in 10 Gen X borrowers pays $1,000 or more per month for their car, a figure that edges closer to housing costs than many people expect. When transportation starts competing with shelter in the budget, that’s never a good sign.

For advisors, auto loans can be a great starting point when meeting with clients as large or extended car payments often signal cash-flow strain. In addition, buying a used vehicle can make a big difference for budgets, freeing up cash to put into savings or investments.

Auto loans rarely drive the planning conversation, but they’re increasingly shaping it. A simple question about car payments can open a much larger discussion about resilience, priorities, and what “affordable” really means in today’s economy.

WEEKLY MARKET RECAP

Commodities took center stage this week, muscling aside mega-cap tech as sharp rallies in precious metals and U.S. natural gas reverberated across global markets.

Gold flirted with the record $5,000-per-ounce mark during Friday's session, capping its strongest weekly performance since March 2020, while silver blasted through the $100-per-ounce threshold to a new all-time high.

Compared with levels a year ago, gold and silver — tracked by the SPDR Gold Shares (GLD) and iShares Silver Trust (SLV) — are now up roughly 81% and 230%, respectively.

Wall Street analysts increasingly described the precious-metal rally as structural rather than speculative, driven by growing private-sector demand for hard assets seen as protection against geopolitical risk and fears over Fed independence.

Silver And Gold Enter Parabolic Mode

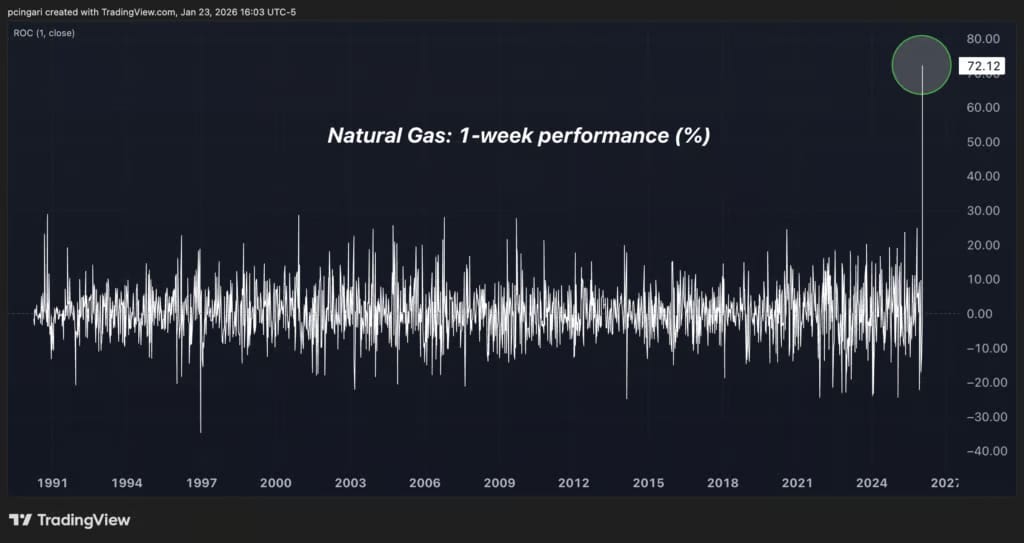

Strongest Weekly Surge Ever For Natural Gas

Meanwhile, an Arctic blast sweeping across the U.S. triggered one of the most extreme price surges ever recorded in the Henry Hub natural gas market.

Prices spiked more than 70% in just a few days, jumping from around $3 per million British thermal units to above $5, as expectations of surging heating demand collided with fears of supply disruptions.

Trump Softens Stance On Europe

U.S. equities experienced a volatile week. Stocks initially sold off on concerns that President Donald Trump could impose new trade tariffs on Europe starting Feb. 1 unless the U.S. obtained ownership of Greenland.

Markets later rebounded sharply after Trump softened his stance, reopening the door to dialogue and negotiations with NATO.

Economic data delivered encouraging signals. The University of Michigan's revised consumer sentiment index for January rose to 56.4 on Friday, above the preliminary 54.0 estimate and marking the highest reading in five months.

Even more important, inflation fears continued to cool. One-year inflation expectations fell to 4.0%, the lowest since early 2025.

This cooling trend is consistent with recent developments in grocery prices. Sugar prices declined 16.6% year over year, wheat fell 10.9% and cheese dropped 7.5%.

Retail egg prices recorded the sharpest move, plunging 26% in January after peaking at a staggering 108% year-over-year increase in March 2025. Chicken breast prices fell 21%, while chicken wing prices collapsed 48% from a year earlier.

What’s Next

Next week, attention shifts to the Federal Reserve's policy meeting on Wednesday, where interest rates are widely expected to remain on hold at 3.50%–3.75%.

The earnings calendar is equally packed: mega-cap tech reports arrive midweek, with Meta (META), Microsoft (MSFT) and Tesla (TSLA) on Wednesday, followed by Apple (AAPL) and Amazon (AMZN) on Thursday.

Investors will also hear from major defense contractors, credit-card giants Mastercard (MA), Visa (V) and American Express (AXP), and energy heavyweights Exxon Mobil (XOM) and Chevron (CVX).

BENZINGA NEWSLETTER SPOTLIGHT

Want more of the news and insights you love? Join hundreds of thousands of readers and explore our other free newsletters for market updates, expert insights, and must-read stories delivered straight to your inbox.

Ring The Bell: Created for market enthusiasts by market enthusiasts, this twice-daily newsletter delivers top stories, fast movers, and hot trade ideas straight to your inbox. Sign up today.

Future Finance: Where fintech, crypto, and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets, and mind-blowing tech trends. Join today.

THE WEEK AHEAD

Economic Data

Monday: Durable-goods orders

Tuesday: Consumer confidence

Wednesday: FOMC interest-rate decision, Fed Chair Powell press conference

Thursday: Initial jobless claims, U.S. trade deficit, Factory orders

Friday: Producer price index (PPI), Fed speeches (Musalem, Bowman)

Earnings

Click here for the full calendar of economic data and earnings reports.

Reminder, if you would like to be featured in our upcoming Advisor Spotlight and showcase your business, click here to send us an email.

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Ring The Bell: Created for market enthusiasts by market enthusiasts, this twice-daily newsletter delivers top stories, fast movers, and hot trade ideas straight to your inbox. Subscribe here.

Future Finance: Where fintech, crypto, and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets, and mind-blowing tech trends. Subscribe here.