- Benzinga Advisor

- Posts

- The $1 Trillion Advisors Keep Overlooking

The $1 Trillion Advisors Keep Overlooking

Plus, the latest in market news.

Happy Sunday, and welcome to Benzinga’s financial advisor newsletter.

Today we’re discussing retirement accounts, where a staggering $1 trillion changed hands last year. Surprisingly, advisors played a small role, and that gap is where the real opportunity lies. Read on to see what’s driving the disconnect, and why it matters.

Plus, a look at all the top stories and market activity from this past week.

Advisor Spotlight: If you would like to be featured in our upcoming Advisor Spotlight and showcase your business, click here to send us an email.

Table of Contents

INDUSTRY CHATTER

Clients don’t always say they’re worried about inflation or layoffs, but their behavior often reveals it. As costs remain elevated and news of workforce reductions continues to pick up, households are quietly reassessing where their money sits and how accessible it feels.

That cautious, proactive behavior shows up clearly in retirement rollovers. Last year, a record $1 trillion moved between retirement accounts, but advisors were involved in only about 22% of those transactions, according to data from research firm Hearts & Wallets. Most rollovers are still happening without professional guidance, even as these moments represent key financial inflection points.

That gap matters — not just for asset flows, but for understanding client behavior. The report showed that consumers are actively shopping and making decisions on their own. Even with advisor-influenced rollovers ticking up from 17% in 2024 to 22% in 2025, the majority of this money is still moving independently.

On the surface, rollover balances may not look transformational. The average rollover was $133,000. About 83% were under $100,000, while roughly 16% exceeded $100,000, with many above $250,000. Individually, these aren’t always headline-grabbing accounts. Collectively, they represent one of the most active moments in a client’s financial life.

What’s driving these moves isn’t performance or product selection. The most common reasons cited were “simplify my finances,” “consolidate for better planning,” and “better service.” That’s a telling list. Clients aren’t signaling a need for more complexity—they’re signaling a desire for clarity and coordination.

There’s also a generational angle worth noting. Rollovers into new employer plans doubled to an estimated $160 billion by the end of 2025, up from $80 billion in 2022. This trend was especially pronounced among late-career workers ages 53 to 64. At the same time, 401(k) recordkeepers and employers are improving retention by offering more investment options and services, reducing the default flow into IRAs.

Zooming out, the broader retirement pool continues to grow. IRAs now hold $18.9 trillion, while defined contribution plans hold $13.9 trillion. Total retirement assets across all vehicles rose to $48.1 trillion during the third quarter last year.

The takeaway for advisors isn’t just about capturing rollovers, it’s about being present in the moments that matter and helping clients navigate life’s complexities. Clients are already moving money, and becoming that trusted guide unlocks more than assets: it builds confidence, strengthens relationships, and makes you the go-to resource whenever important financial decisions arise.

WEEKLY MARKET RECAP

It was a crowded week on Wall Street, with a Federal Reserve meeting and a slate of major tech earnings. But the moment that ultimately mattered most came Friday morning, when President Donald Trump nominated Kevin Warsh as the next Chair of the Federal Reserve.

Warsh is set to replace Jerome Powell when Powell's term expires in May. A former Federal Reserve governor from 2006 to 2011, Warsh was one of the youngest policymakers in modern Fed history, joining the Board at just 35.

Warsh is also well known as a long-time critic of quantitative easing, the policy that expanded the Fed's balance sheet through large-scale asset purchases following the financial crisis.

Fears Over Fed Independence Vanish

To markets, Warsh's nomination signals a Federal Reserve less willing to aggressively cut interest rates, following weeks of concern that monetary policy could tilt toward easier conditions to accommodate President Trump's political agenda.

The market reaction was swift. Trends that had dominated markets for much of the month abruptly reversed. The U.S. dollar, which had fallen to four-year lows, found support. Meanwhile, the powerful rally in precious metals came to a sudden halt.

Silver, which on Thursday had surged roughly 60% on the month — its strongest monthly performance since the U.S. Civil War in 1864 — fell about 30% on Friday morning alone, marking its worst day since 1980.

Gold followed with a roughly 10% decline – another move unseen in over four decades.

In earnings, the biggest shock came from Microsoft (MSFT), whose shares plunged about 10% on Thursday — their worst session since March 2020 — despite reporting stronger-than-expected earnings. Investors instead focused on slowing Azure cloud growth and cautious guidance, reviving doubts about the pace and sustainability of AI monetization.

Meta (META) delivered the opposite surprise. Shares rallied after a record quarter, with revenue up roughly 24% year over year and daily active users across its apps rising to about 3.58 billion.

Elsewhere in tech, a supply-side squeeze continued to drive outsized gains for memory and storage chipmakers such as SanDisk (SNDK), Seagate (STX), Western Digital (WDC) and Micron (MU), all up more than 50% year to date.

Meanwhile, Michigan-based stocks capped off a strong month. General Motors (GM) extended its rally to a seventh straight month — its longest winning streak since returning to public markets in 2011 — closing at record highs. Ford Motor (F) gained about 5%, finishing January at its highest level since July 2023.

BENZINGA NEWSLETTER SPOTLIGHT

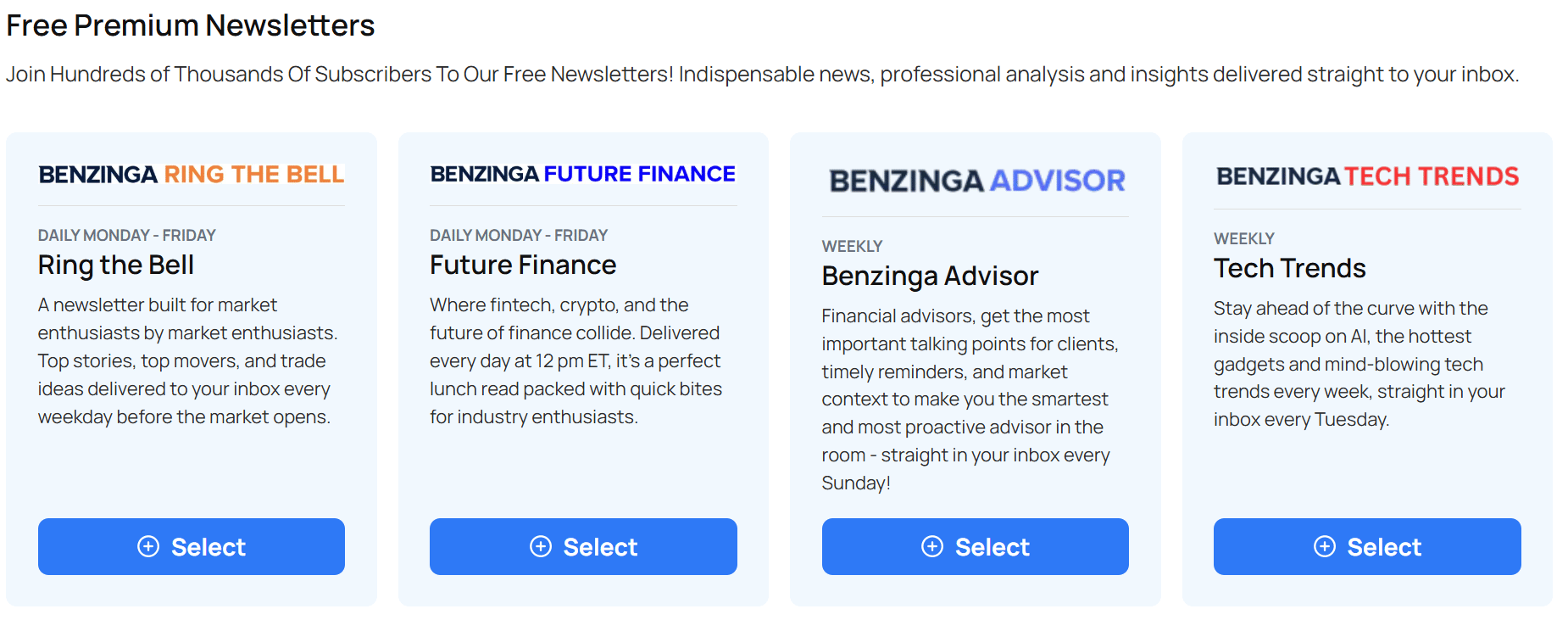

Want more of the news and insights you love? Join hundreds of thousands of readers and explore our other free newsletters for market updates, expert insights, and must-read stories delivered straight to your inbox.

Ring The Bell: Created for market enthusiasts by market enthusiasts, this twice-daily newsletter delivers top stories, fast movers, and hot trade ideas straight to your inbox. Sign up today.

Future Finance: Where fintech, crypto, and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets, and mind-blowing tech trends. Join today.

THE WEEK AHEAD

Economic Data

Monday: Auto sales, ISM manufacturing

Tuesday: Job openings, ISM services

Wednesday: ADP employment, Crude oil inventories

Thursday: Initial jobless claims, Fed speech (Bostic)

Friday: Unemployment report, Hourly wages, Consumer sentiment

Earnings

Monday: Palantir (PLTR), Walt Disney (DIS), NXP Semiconductors (NXPI),

Tuesday: AMD (AMD), Merck (MRK), Amgen (AMGN), Pepsico (PEP)

Wednesday: Alphabet (GOOG), Eli Lilly (LLY), Uber (UBER) Qualcomm (QCOM), O'Reilly (ORLY), Novo Nordisk (NVO)

Thursday: Amazon (AMZN), Shell (SHEL), Cummins (CMI), Reddit (RDDT)

Click here for the full calendar of economic data and earnings reports.

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Ring The Bell: Created for market enthusiasts by market enthusiasts, this twice-daily newsletter delivers top stories, fast movers, and hot trade ideas straight to your inbox. Subscribe here.

Future Finance: Where fintech, crypto, and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets, and mind-blowing tech trends. Subscribe here.