- Benzinga Advisor

- Posts

- The $461B Boom That Advisors Can’t Ignore

The $461B Boom That Advisors Can’t Ignore

Plus, the latest in market news.

Happy Sunday, and welcome to Benzinga’s financial advisor newsletter.

Today we're talking about investment options. Despite tariff shocks and midyear turbulence, stocks climbed to fresh highs in 2025 and continue to climb higher this year as well. Yet beyond the headlines, another segment of the financial landscape was breaking records of its own: Annuities. Read on to see what’s driving the momentum.

Plus, a look at all the top stories and market activity from this past week.

Advisor Spotlight: If you would like to be featured in our upcoming Advisor Spotlight and showcase your business, click here to send us an email.

Table of Contents

INDUSTRY CHATTER

The stock market delivered another strong performance last year, with the S&P 500 finishing up 16.4%, capping three consecutive years of double-digit gains driven heavily by tech and AI-related names. Despite some early turbulence — including a sharp drop on Liberation Day amid worldwide tariffs — markets climbed the wall of worry, rebounding sharply and hitting new highs by year-end.

But that wasn’t the only thing breaking records.

Annuities, which have had a mixed reputation — loved for their guarantees but often avoided due to complexity or cost — shattered records for a fourth consecutive year. According to LIMRA’s annuity survey, U.S. retail annuity volume rose 6% to $461.3 billion in 2025, with fourth-quarter sales up 12% to $114.4 billion, marking the ninth straight quarter above $100 billion.

What’s driving this resurgence amid a bull market? For many clients, market volatility and interest rate uncertainty make guarantees more appealing than chasing returns. Fixed or index-linked annuities can provide a predictable floor and, in some cases, lifetime income streams — features that feel especially attractive to older generations or those nearing retirement.

In addition, older generations which have lived through the dot-com bubble and the great financial crisis (2007-09), are aware of how quickly gains can evaporate. And poor returns early in retirement often leads to derailed spending plans for years.

This reality is fueling demand for products blending growth potential with guardrails. Indexed annuities stole the show: combined fixed indexed annuities (FIAs) and registered index-linked annuities (RILAs) captured 45% of total sales (up from 24% a decade ago). Last year, RILAs grew fastest, up 20% to $79.6 billion, with projections for more than $85 billion in 2026 as more carriers enter and products improve. FIAs hit their own record at $128.2 billion, while fixed-rate deferred (FRD) annuities saw the most at $160.6 billion.

For advisors, this isn't about pushing annuities universally, but about recognizing what the data reveals in client conversations:

Downside protection resonates — Clients who've watched portfolios swing (even in an up year) often want a portion shielded for essentials, freeing the rest for growth-oriented assets.

Behavioral edge — Indexed options provide equity-like participation without full exposure, helping curb panic selling during drawdowns — a common retiree regret.

Income security as priority — With longevity risks rising and modest balances common, guaranteed elements can anchor spending plans, reducing the mental load of constant market-watching.

Cross-generational relevance — Boomers are driving much of today's volume, but Gen X (and eventually Millennials) face the same pension void plus potentially longer retirements. Early discussions build credibility.

The rise in annuity adoption isn’t just a stat; it’s a reflection of client priorities in today’s economic environment. For advisors, it’s a reminder that planning isn’t just about chasing returns — it’s about addressing client fears, behavioral biases, and the desire for certainty. Sometimes, the right solution is less about beating the market and more about giving clients peace of mind.

WEEKLY MARKET RECAP

Wall Street got the kind of macro backdrop investors typically celebrate — solid job growth and easing inflation — yet stocks struggled to gain traction as concerns over tech costs and margin pressure capped enthusiasm.

January Jobs Report Beats Expectations

The U.S. economy added 130,000 nonfarm payrolls in January, well above expectations of 70,000. Private employers accounted for 172,000 of those jobs, the strongest gain since December 2024.

Government payrolls dropped by 42,000, the fourth consecutive monthly decline.

The unemployment rate edged down to 4.3% from 4.4%, another positive signal. While the Bureau of Labor Statistics revised down prior payroll estimates by 898,000 jobs between April 2024 and March 2025, investors largely treated that adjustment as backward-looking.

Inflation Cools Further, Bolstering Fed Cut Hopes

Inflation also offered reasons to cheer. Consumer prices rose 2.4% year over year in January, down from 2.7% and below forecasts of 2.5%. That marked the lowest reading in eight months.

Core inflation, which strips out food and energy, eased to 2.5%, the lowest since March 2021.

There is growing room to expect additional interest-rate cuts ahead, with markets currently pricing in at least two reductions by year-end.

Under normal circumstances, that combination would fuel a broad rally. This time, it failed to move the needle.

Tech Drag Offsets Macro Tailwinds

The S&P 500 – as tracked by the SPDR S&P 500 ETF Trust (SPY) – finished the week little changed. Technology stocks lagged, pressured after Cisco (CSCO) posted weaker-than-expected margins.

Tech industry leaders are citing higher costs for memory and storage products amid a global supply crunch, reviving concerns that AI infrastructure spending may compress profits across the software and hardware ecosystem.

On Thursday, 10 tech giants wiped out over $500 billion in market capitalization in a single session.

Ford Rallies Despite Earnings Miss

In Detroit, Ford (F) moved higher despite missing earnings estimates as the 2026 guidance outperformed expectations. The automaker posted revenue of $42.45 billion, above the $41.53 billion consensus estimate, though down 5% from a year earlier.

"Ford delivered a strong 2025 in a dynamic and often volatile environment," said Jim Farley, president and CEO of Ford.

The automaker absorbed roughly $2 billion in losses tied to fires at a Novelis aluminum supplier plant in New York. It also faced a $2 billion net tariff headwind, including $1 billion in unexpected costs after delays in auto-parts tariff credits.

Results included $15.5 billion in special charges linked largely to scaling back electric vehicle plans announced in December.

Shares rallied for three straight sessions after the report and tested January highs. Farley also approved higher bonuses for 75,000 salaried employees, citing better vehicle quality.

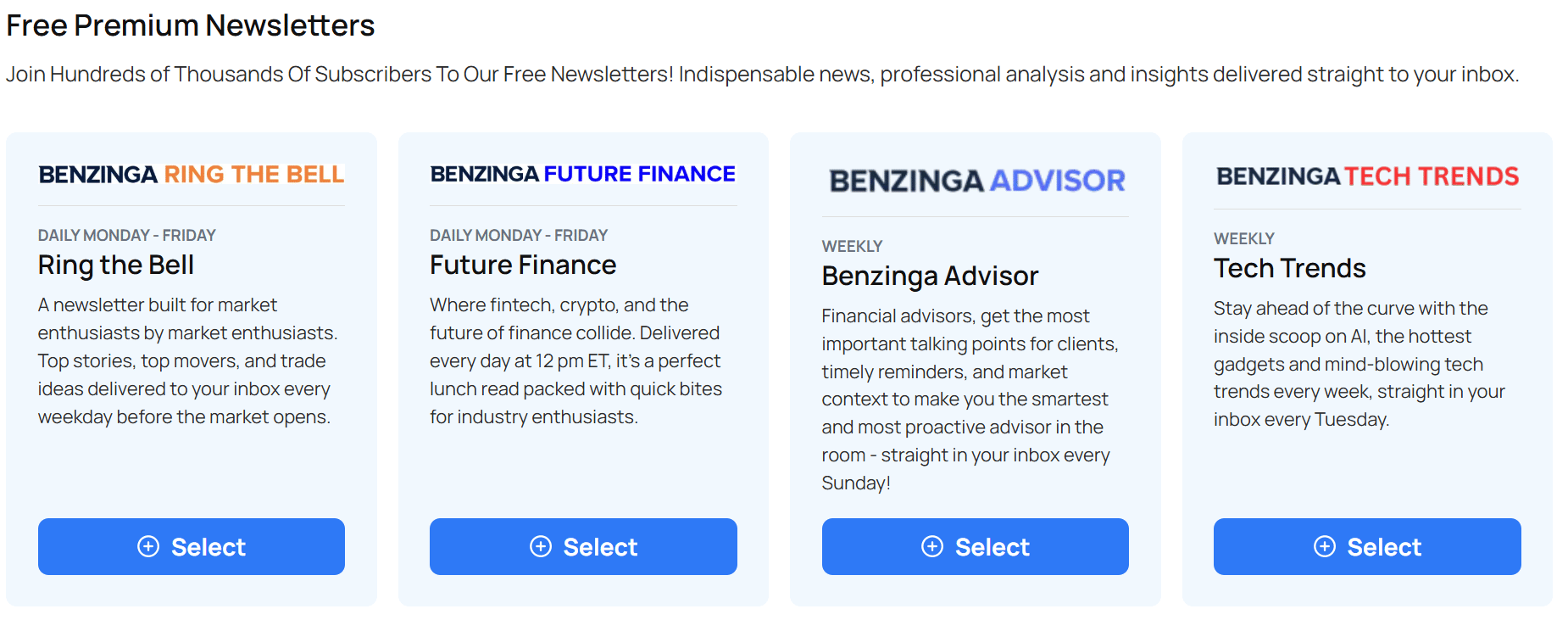

BENZINGA NEWSLETTER SPOTLIGHT

Want more of the news and insights you love? Join hundreds of thousands of readers and explore our other free newsletters for market updates, expert insights, and must-read stories delivered straight to your inbox.

Ring The Bell: Created for market enthusiasts by market enthusiasts, this twice-daily newsletter delivers top stories, fast movers, and hot trade ideas straight to your inbox. Sign up today.

Future Finance: Where fintech, crypto, and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets, and mind-blowing tech trends. Join today.

THE WEEK AHEAD

Economic Data

Monday: Holiday (President's Day)

Tuesday: Empire State manufacturing survey, Home builder confidence index

Wednesday: Building permits, Industrial production, FOMC minutes

Thursday: Initial jobless claims, U.S. trade deficit, Leading economic index

Friday: Personal income/spending, PCE, PMI, Consumer sentiment

Earnings

Click here for the full calendar of economic data and earnings reports.

Reminder, if you would like to be featured in our upcoming Advisor Spotlight and showcase your business, click here to send us an email.

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Ring The Bell: Created for market enthusiasts by market enthusiasts, this twice-daily newsletter delivers top stories, fast movers, and hot trade ideas straight to your inbox. Subscribe here.

Future Finance: Where fintech, crypto, and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets, and mind-blowing tech trends. Subscribe here.