- Benzinga Advisor

- Posts

- The Down Payment Problem Advisors Can’t Ignore

The Down Payment Problem Advisors Can’t Ignore

Plus, the latest in market news.

Happy Sunday, and welcome to Benzinga’s financial advisor newsletter.

Today we're talking about home ownership and the tough choices facing first-time homebuyers. As prices stay high and savings fall short, a once-unthinkable funding source is creeping into the conversation — and it has advisors, policymakers, and buyers divided. Read on to see what this trend says about the current state of “housing affordability” and its impact on retirement savings.

Plus, a look at all the top stories and market activity from this past week.

Advisor Spotlight: If you would like to be featured in our upcoming Advisor Spotlight and showcase your business, click here to send us an email.

Table of Contents

INDUSTRY CHATTER

For younger generations, the American Dream of homeownership is starting to feel less like a milestone and more like a moving target. As prices rise and savings lag behind, buyers are increasingly forced to rethink where the down payment is supposed to come from — with Gen Z even borrowing from family to make things work.

With prices still high and first-time buyers feeling squeezed, the idea of tapping into a 401(k) sounds like a reasonable release valve if family help isn’t an option. However, from financial advisors to President Trump, many are pushing back — and for good reason.

On paper, the math looks tempting. The median single-family home price is roughly $433,00. A 10% down payment is $43,000, which is nearly the median 401(k) balance for first-time homebuyers in their late 30s or early 40s.

But that still masks the problem.

For most younger buyers, retirement accounts simply aren’t big enough to solve the affordability issue without creating a new one. Draining that account to buy a home doesn’t “unlock” ownership — it often just shifts risk from one part of the balance sheet to another.

From an advisor’s perspective, this is less about rules and more about trade-offs. A client who needs to tap retirement funds for a down payment is usually signaling one of three things:

The home may be too expensive for their current cash flow

The timeline is being rushed by emotional or social pressure

Other savings habits haven’t had time to mature

Moving money from a tax-advantaged account into an illiquid asset with ongoing costs doesn’t solve any of these issues — it just trades one challenge for another.

At its core, the problem isn’t access to retirement funds. It’s affordability. Home prices have climbed sharply over the past five years, interest rates remain elevated, and inventory is tight. Allowing easier access to 401(k)s doesn’t change those fundamentals — it just shifts where the strain shows up.

The renewed attention on using retirement savings for down payments highlights how stretched today’s first-time buyers have become. For advisors, it’s a useful data point that signals how far housing affordability has drifted from traditional saving paths.

Gold and silver had a moment in 2025, and thus far, momentum is continuing into 2026. Furthermore, as Sprott’s Ed Coyne shared in a recent video, it wasn’t lost on investors that many of the gold and silver miners have outperformed the S&P 500. All of this means that we’re now seeing more advisors start to take this space seriously, shared Coyne.

“The old 60/40 model (60% stocks, 40% bonds) tends to break down when discussing advisors… Jamie Dimon is saying it's now really 60/20/20, with 20% being alternatives, and within that, gold is included; more advisors are starting to embrace this as well,” Coyne said.

Check out the full video here and learn why Sprott’s Active Gold & Silver Miners ETF (GBUG) has been gaining in popularity. For more information on GBUG, click here.

Disclaimer: Past performance is no guarantee of future results. The S&P 500 tracks the performance of 500 large, publicly traded U.S. companies and is widely used as a benchmark for the overall U.S. stock market. One cannot invest directly in an index.

This is a paid ad. Please see 17b disclosure here for more information.

WEEKLY MARKET RECAP

Wall Street saw a dramatic rotation this week, as investors fled once-reliable software stocks in the wake of mounting fears that generative artificial intelligence could permanently erode demand for traditional digital services.

Software stocks – tracked by the iShares Tech-Expanded Software Sector ETF (NYSE:IGV) – tumbled nearly 20% over the week, marking one of the fund’s worst weekly performances since the 2022 tech rout.

Names that once defined growth and innovation are now under pressure, as emerging AI platforms such as Anthropic's Claude Cowork and Google's Genie 3 threatened to cannibalize the very sectors they helped build.

Palantir Technologies Inc. (NASDAQ:PLTR) – the poster-child of the AI-led software rally – fell for the fourth straight week. Other software giants such as ServiceNow Inc. (NASDAQ:NOW), Oracle Corp. (NYSE:ORCL) and Intuit Inc. (NASDAQ:INTU) all posted double-digit losses for the week.

While tech sold off sharply, the Dow Jones Industrial Average notched fresh record highs Friday, topping the 50,000-point milestone, with its limited tech exposure proving to be a key advantage.

The blue-chip index outperformed the Nasdaq 100 for seven consecutive sessions, its longest such stretch in nearly four years.

Chart Of The Week: Dow Jones Rallies To Records, While Software’s AI-Trade Falls Apart

Despite Alphabet (GOOGL) and Amazon (AMZN) delivering strong earnings, shares plummeted amid concerns that soaring AI infrastructure spending could reduce near-term shareholder returns.

Bank of America's chief investment strategist, Michael Hartnett, said investors should go "Long Detroit, Short Davos," favoring Main Street-focused cyclicals over Silicon Valley giants, suggesting a fundamental shift in market leadership.

According to Gina Bolvin, president of Bolvin Wealth Management Group, the takeaway for investors is to “lean into quality businesses with strong earnings power and be prepared for more rotation, not straight-line gains.”

The pivot away from tech was not just financial — it was also tied to labor concerns.

The latest Challenger, Gray & Christmas report announced 108,435 job cuts in January, up 205% from December. AI accounted for 7,624 of those, or 7%, the highest monthly share since tracking began in 2023.

Nearly 80,000 layoffs have been linked to AI since then. At the same time, consumers appeared less anxious about inflation. The University of Michigan's February survey showed one-year inflation expectations fell to 3.5%, their lowest since January 2025, coinciding with Donald Trump's second inauguration.

In short, investors are questioning the once-unshakable dominance of software and tech. If AI is the disruptor, then value, cyclicals and tangible businesses may be the beneficiaries.

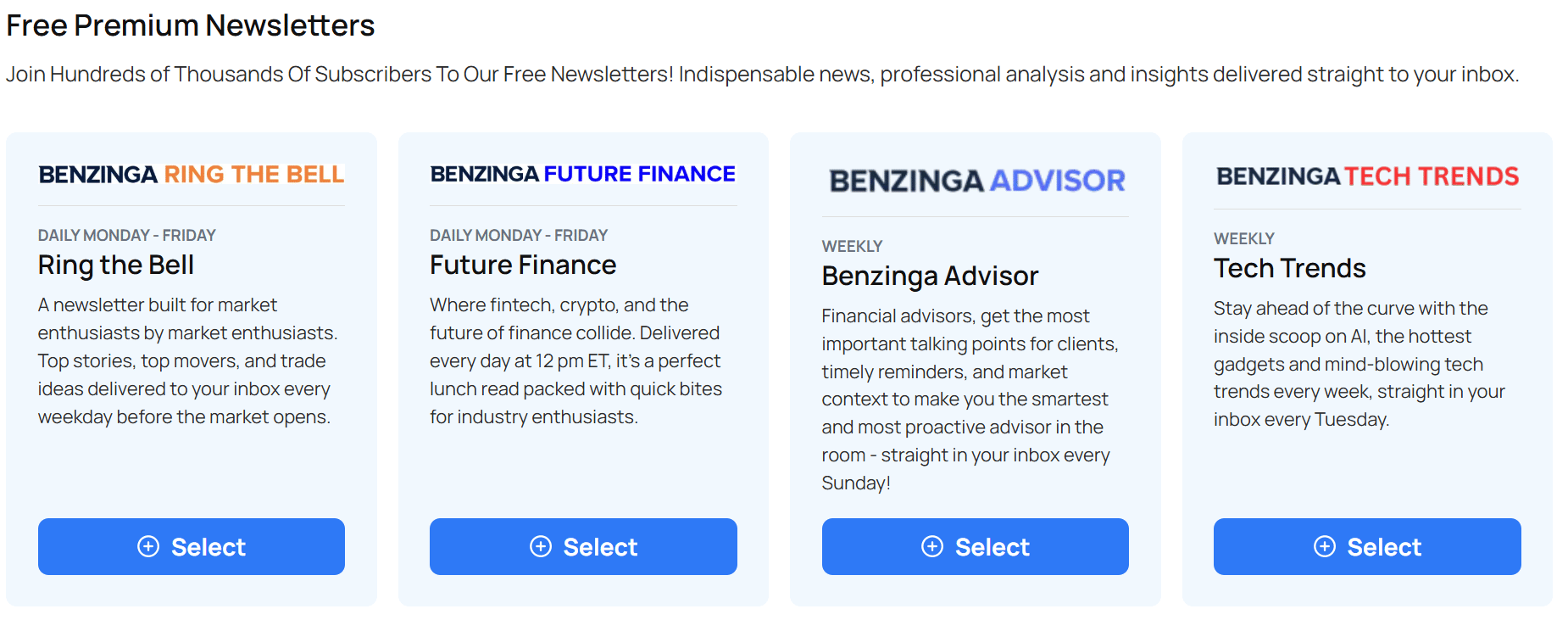

BENZINGA NEWSLETTER SPOTLIGHT

Want more of the news and insights you love? Join hundreds of thousands of readers and explore our other free newsletters for market updates, expert insights, and must-read stories delivered straight to your inbox.

Ring The Bell: Created for market enthusiasts by market enthusiasts, this twice-daily newsletter delivers top stories, fast movers, and hot trade ideas straight to your inbox. Sign up today.

Future Finance: Where fintech, crypto, and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets, and mind-blowing tech trends. Join today.

THE WEEK AHEAD

Economic Data

Monday: Fed speeches (Bostic, Waller, Miran)

Tuesday: Import price index, U.S. retail sales, Business inventories

Wednesday: Unemployment report, hourly wages,

Thursday: Initial jobless claims, Existing home sales,

Friday: Consumer price index (CPI)

Earnings

Click here for the full calendar of economic data and earnings reports.

Reminder, if you would like to be featured in our upcoming Advisor Spotlight and showcase your business, click here to send us an email.

BEFORE YOU GO

Were you forwarded this email? Click here to subscribe.

And be sure to check out our other newsletters:

Ring The Bell: Created for market enthusiasts by market enthusiasts, this twice-daily newsletter delivers top stories, fast movers, and hot trade ideas straight to your inbox. Subscribe here.

Future Finance: Where fintech, crypto, and the future of finance collide. Future Finance is a perfect lunch read packed with quick bites for industry enthusiasts. Subscribe here.

Tech Trends: Get the inside scoop on AI, the hottest gadgets, and mind-blowing tech trends. Subscribe here.